Programme Partner

Module 1

Directors' Duties, Responsibilities and Legal Obligations

Module 2

Governing the Financial and Strategic Performance

Module 3

Board Dynamics and Culture in a Digital Age

Module 4

Risk Management and Cybersecurity Governance

Module 5

Sustainability Governance

Module 6

Effective Succession Planning and Compensation Decisions

Module 7

AI Governance (Elective)

Overview

This programme offers an ideal opportunity to strengthen your understanding of the director’s role and how to serve the firm more effectively.

The role of the company director continues to be shaped by a multitude of forces including economic uncertainty, larger and more complex organizations, the accelerating pace of technological innovation and a more rigorous regulatory environment. At the same time there is greater onus on directors to operate transparently and be more accountable for their actions and decisions.

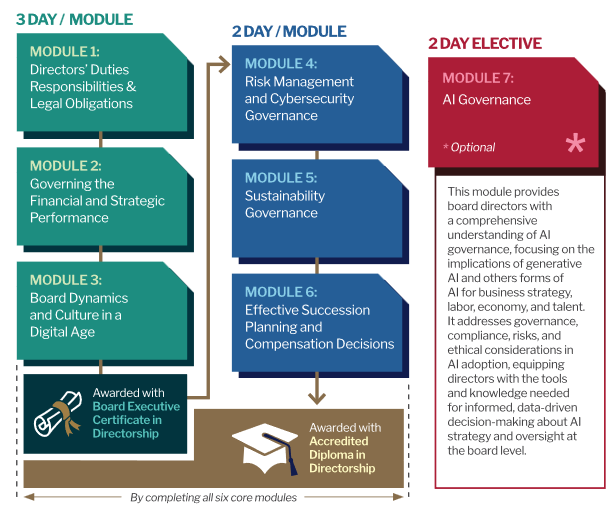

Launched in 2007 in partnership with Singapore Institute of Directors (SID) and continuously updated, the Singapore Directorship Programme (SDP) is one of the leading local directorship training programmes that leads to the SID Accredited Director status with exam exemption. Set within an Asian context, the six core modules and one elective module are designed to enhance participants’ boardroom skills and update their knowledge and capabilities to navigate an increasingly complex business environment.

The SDP is structured in two parts, inline with SID's Accreditation Framework. Participants can obtain a Board Executive Certificate in Directorship by completing the first three modules or continue to obtain a full Accredited Diploma in Directorship by completing all six core modules successfully, with the option to take up module 7 as an elective. The modules can be taken non-sequentially in a period of 24-36 months, providing scheduling flexibility. The first three modules are especially catered to C-suites and senior executives who desire to acquire the foundational knowledge required to prepare themselves to become board directors.

Learning Methods

Each module relies heavily on peer learning and the collective intelligence and experience of the participants. Questions and objections are thus highly encouraged during the interactive lectures, group discussions, case studies and simulations. Each module is followed by an assessment made of multiple-choice questions and at least one open question which challenges the participants to translate the learning of the module to their organisation or an organisation that they know well.

SID Director Competency Model

The SDP is developed in alignment with the SID Director Competency Model[1], as follows

Competency Area | Definition | MODULES | ||||||

|---|---|---|---|---|---|---|---|---|

1 | 2 | 3 | 4 | 5 | 6 | 7 | ||

Governance | The ability to effect appropriate governance structures and corporate culture to guide and progress the business affairs of the company in a manner that enhances long-term shareholder value, whilst taking into account the interests of other stakeholders. | X | X | X | X | X | X | X |

Duties and Practice | The understanding of what the role and duties of a board director entails. The ability to adopt board practices that will lead to a credible, and efficient Board and a constructive relationship with Management. | X |

| X |

|

|

|

|

Financial | The ability to review financial statements, question accounting treatments, establish internal controls and ensure financial statements and accounting standards are in accordance with ACRA requirements. | X |

|

|

|

|

| |

Risk | The ability to assess, manage and mitigate risks an organization faces as part of its business, financial, legal, strategic, human and digital activities. This includes the appropriate risk tolerance to minimise liability and safeguard the long-term success of the organisation. | X | X | X | X | X |

| X |

Strategy | The ability to participate in the development of the company’s strategic plan, identify business options and consider the best strategy to achieve organisational goals. |

| X | X |

| X |

| X |

Digital | The ability to provide direction and advice on how digital technology can enable business strategy, oversight for financial investment into digital assets, and governance for high-risk investments that are integrated with business strategy and financial management practices. |

|

| X | X |

|

| X |

Human Capital | The ability to enhance human capital and workplace issues such as diversity, culture, performance, employee engagement and talent, that support business strategy and impact corporate culture. |

|

| X |

|

| X | X |

Sustainability | The ability to define structures, policies and processes necessary for a company to manage sustainability response to potential financial risks and opportunities. |

|

|

|

| X |

|

|

- Next Course Starts On See each module's scheduleSee Full Schedule

- Fee Learn More

- Duration2-3 days per module

- LevelAdvanced

- VenueSingapore Management University

Learning Objectives

➤ Increased understanding of the role of company directors.

➤ Provide practical frameworks and strategies for effectively managing critical issues related to risk management, C-level succession planning, compensation and more.

➤ Overview and development of key frameworks for addressing legal issues and prudent strategies to help boards navigate today's litigious environment.

➤ Facilitate soft skills development for managing relationships and challenging discussions among board members.

Topics/Structure

Module Objectives:

- Explain the structure, operations and responsibilities of stakeholders and the board.

- Describe the role and duties of directors on a board, and directors' inter- relationships.

- Understand the contents of the Company Act and SGX listing regulation as it applies to Board. directors and how directors can fall foul of this legislation.

- Explain the consequences of a breach of director obligations.

- Fully grasp what good governance means

Module Objectives:

- What is the Board's responsibility in oversight of company strategy?

- How can the Board assist in promoting growth and what growth is beneficial to stakeholders?

- How to evaluate the financial health of companies using accepted methods in financial statement analyses? What are critical financial performance measures?

- Understand how to evaluate and make rational financial decisions.

- Explain how various actions and alignment or misalignment will impact long-term shareholder and stakeholder value.

- Ensure appropriate and effective investment decisions.

Module Objectives:

- How to assess the organisation’s readiness for a successful digital transformation and key related digital investments?

- The increased role of organisational culture and leadership to succeed in a digital age.

- What are the interpersonal and procedural tactics for influencing group decisions?

- How trust can be nurtured between directors, even in situations of crisis and tensions, and how to deal with conflictual situations with the executive leadership team?

- What are the key ingredients of board collective performance?

- How the board culture impacts the organisational culture?

- The role of the chair as a facilitator of difficult conversations: Relevant behaviours and interpersonal styles

Module Objectives:

- Understand the various lines of defense to ensure effective controls within the firm.

- Identify early warning systems in place to alert the board and senior management to emerging risks and assist developing strategies to anticipate and prevent crises from occurring.

- Appreciate if the right risks are being identified, assessed and managed - with a focus on quality over quantity.

- Understand risk appetite/ tolerance levels set for the company and the impact of this on strategy.

- Appreciate the level of oversight of crisis management and business continuity.

- Establish the appropriate ‘tone at the top’ to reinforce and promote a risk aware culture.

- Efficiently leverage cybersecurity to ensure business continuity and resilience.

Module Objectives:

- Understand how ESG expands your fiduciary and accountability duties in your role as steward of your company’s long-term success.

- Ensure that the corporation can explain to its stakeholders what role it is playing in addressing societal and environmental challenges.

- Understand how sustainable business practices result in improved financial performance for corporations.

- Identify and prioritise ESG risks and opportunities and associated management KPIs.

- Be ready to lead conversations and ask the right questions in and out of the boardroom by acquiring deeper ESG literacy.

- Oversee how sustainability is taken into consideration in culture, processes and talent management.

Module Objectives:

- Understand the roles and responsibilities of, and differences between, the Nominating and Remuneration committees.

- Provide an understanding of how to design a succession planning programme to ensure continuity of talent in key C-suite positions and of the Chairman and within the Board itself.

- Share approach to define the need for these key leadership roles and identify which employees should be developed to fill these positions in the future.

- Ascertain robust processes for evaluation of Chairman, Board and C-suite to ensure a wide range of competencies and experience to effectively deal with the opportunities and issues the company faces.

- Provide insight on how to develop effective compensation plans that are closely linked to a company’s talent strategy and aligned with its goal of creating shareholder value.

- Outline the different methods by which CEO and top executive compensation is benchmarked and measured.

- Assess Board reward / risks equation and assess how these risks be dealt with (e.g. D&O insurance)

Module Objectives:

- Understand the fundamentals and current state of generative AI technology.

- Explore the AI ecosystem, including key players and economic dynamics.

- Assess the impact of generative AI on business, labor, economy, and talent.

- Identify governance, compliance, and ethical considerations in AI adoption.

- Develop effective strategies for AI implementation and oversight at the board level.

- Navigate risks and challenges associated with early AI technology adoption.

- Make informed, data-driven decisions regarding AI strategy and governance.

Module 1

Directors' Duties, Responsibilities and Legal Obligations

Next course starts on: (See complete schedule)

Overview

Company directors have significant legal responsibilities in the Singapore environment. It is critical to understand these duties, maintain compliance and continuously keep abreast of any relevant changes to regulations and guidance.

In this module, you will learn from the Companies’ Act as well as the general law and recent case studies to gain a sound understanding of the distribution of power, the duties and obligations of a board director and the possible consequences of breaches of those obligations.

Start Date(s):

Run 1: 7 - 9 Jan 2026 (Wed to Fri) - FULL

Run 2: 6 - 8 May 2026 (Wed to Fri)

Run 3: 13 - 15 May 2026 (Wed to Fri)

Please contact Desmond Ng at desmondngjj@smu.edu.sg for more information.

You can choose to take this module only. Learn more

Module 2

Governing the Financial and Strategic Performance

Next course starts on: (See complete schedule)

Overview

This module explores the integral relationship between strategy and finance, emphasizing the pivotal role of Boards in evaluating corporate performance and creating value.

Directors, equipped with sufficient financial literacy, are responsible for making informed decisions and sharing collective accountability for their firm's financial outcomes, while certain tasks are delegated to the audit committee. Concurrently, Boards are tasked with developing, communicating, and assessing corporate strategy, ensuring the company's agility and ability to adapt to business and economic shifts. This dual focus enables the company to seize emerging opportunities, thus fostering sustainable value for stakeholders.

Start Date(s):

Run 1: 9 - 11 Feb 2026 (Mon to Wed) - FULL

Run 2: 22 - 24 Jun 2026 (Mon to Wed)

Run 3: 1 - 3 Jul 2026 (Wed to Fri)

Please contact Desmond Ng at desmondngjj@smu.edu.sg for more information.

You can choose to take this module only. Learn more

Module 3

Board Dynamics and Culture in a Digital Age

Next course starts on: (See complete schedule)

Overview

This module explores two key connected topics. First, it covers how the board can provide direction and advice on how digital technology can enable business strategy. Second, it covers the dynamics inside the Board and how directors can effectively influence each other and constructively manage tensions between them in the most effective way and in the interest of the organization.

It will also highlight the critical role of the chair in fostering an open and transparent board culture and creating alignment. On the last day, participants will participate in a board crisis simulation in a fictitious digital company.

Start Date(s):

Run 1: 11 - 13 Mar 2026 (Wed to Fri)

Run 2: 15 - 17 Jul 2026 (Wed to Fri) - FULL

Run 3: 29 - 31 Jul 2026 (Wed to Fri)

Please contact Desmond Ng at desmondngjj@smu.edu.sg for more information.

You can choose to take this module only. Learn more

Module 4

Risk Management & Cybersecurity Governance

Next course starts on: (See complete schedule)

Overview

The Board has ultimate responsibility for managing risks. The Board should determine the company’s levels of risk tolerance and risk policies, and advise management in the design, implementation and monitoring of the risk management and internal control systems intended to avert crises.

Consequently, the Board must work with management in dealing with unpredictable events which may lead to crisis. Of particular importance in our digital world, cybersecurity is now a core component of risk management.

Start Date(s):

Run 1: 23 - 24 Apr 2026 (Thu to Fri) - FULL

Run 2 & 3: 10 - 11 Sep 2026 (Thu to Fri)

Please contact Desmond Ng at desmondngjj@smu.edu.sg for further information.

You can choose to take this module only. Learn more

Module 5

Sustainability Governance

Next course starts on: (See complete schedule)

Overview

As a steward of your company's long-term success, it's critical to understand how ESG expands your reporting, fiduciary and accountability duties.

By incorporating ESG considerations into your decision-making processes as a board director, you can ensure that your corporation can not only develop sustainable business practices but also explain to its stakeholders what role it is playing in addressing societal and environmental challenges.

Start Date(s):

Run 1: 18 - 19 May 2026 (Mon to Tue) - FULL

Run 2: 26 - 27 Oct 2026 (Mon to Tue)

Run 3: 27 - 28 Oct 2026 (Tue to Wed)

Please contact Desmond Ng at desmondngjj@smu.edu.sg for further information.

You can choose to take this module only. Learn more

Module 6

Effective Succession Planning and Compensation Decisions

Next course starts on: (See complete schedule)

Overview

This module is designed to equip participants with the knowledge to design effective succession planning programmes, understand and define key leadership roles, implement robust evaluation processes, develop strategic compensation plans, and navigate the complexities of executive compensation benchmarking.

Through practical discussions and case studies, participants will learn how to balance Board rewards and risks, ensuring your company's leadership is poised for sustainable success and long-term value creation.

Start Date(s):

Run 1: 25 - 26 Jun 2026 (Thu to Fri) - FULL

Run 2 & 3: 26 - 27 Nov 2026 (Thu to Fri)

Please contact Desmond Ng at desmondngjj@smu.edu.sg for further information.

You can choose to take this module only. Learn more

Module 7

AI Governance (elective)

Next course starts on: (See complete schedule)

Overview

This module provides board directors with a comprehensive understanding of AI governance, focusing on the implications of generative AI and others forms of AI for business strategy, labor, economy, and talent.

It addresses governance, compliance, risks, and ethical considerations in AI adoption, equipping directors with the tools and knowledge needed for informed, data-driven decision-making about AI strategy and oversight at the board level.

Start Date(s):

Run 1: 5 - 6 Mar 2026 (Thu to Fri) - FULL

Please contact Desmond Ng at desmondngjj@smu.edu.sg for further information.

You can choose to take this module only. Learn more