What is digital disruption and transformation?

Dr Patrick Thng spoke at SMU’s Future Ready Forum 2016 on “Digital Disruption: What, Why and How for the C-level Executives”.

By SMU Executive Development

8 April 2016

Using social media in your company to brand yourself isn’t digital disruption, while using data analytics to better understand your customers’ buying habits also doesn’t count. Digital disruption must have some form of innovation, and happens when a new entrant brings in superior technology to better meet the needs of the mass market.

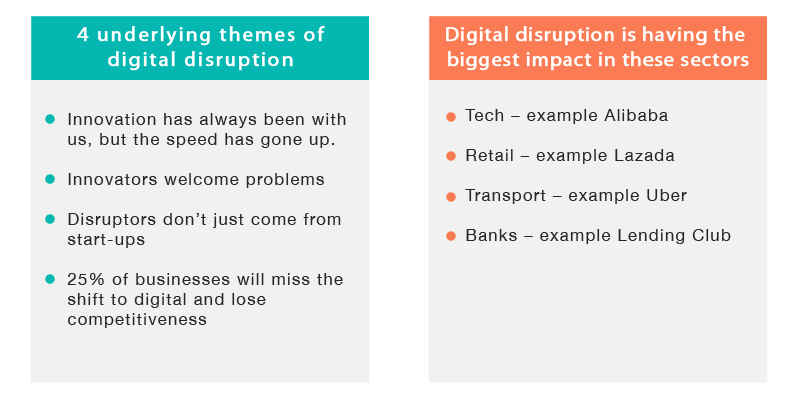

More importantly, digital disruptors don’t just come from start-ups. That was one of the key messages Dr Patrick Thng, SMU's full-time faculty and Principal Lecturer of Information Systems highlighted in a series of talks held recently at the Future Ready Forum 2016.

Some companies don’t always understand what digital disruption is. While most people think of internet start-ups as the chief digital disruptors, they can also spring up within large and traditional organisations. For example, a number of banks have set up innovation centres which are generating ideas and innovations for their customers.

But of course there are many well-known start-ups which were launched specifically to disrupt traditional players. Recent examples include Uber and Airbnb. The interesting fact about these companies is that Uber is the world’s largest taxi company but owns no vehicles, while Airbnb is the world’s largest accommodation provider but owns no real estate.

Patrick highlighted what he considers are the biggest opportunities within the digital disruption space. These include financial technology (fintech) in banking, and analytics combined with the Internet of Things (IoT)—particularly the use of sensors in the insurance industry. For example, sensors in cars can quickly determine the cause of an accident, the data can be uploaded and sent to the insurer, and a payment made within 24 hours.

Talking about using the power of disruption within an organisation, Patrick said, “CEOs and senior leadership must provide the role model in digitisation, encouraging future sensing by educating yourself and your business leadership team.”

About Dr Patrick Thng

Patrick Thng is a 30-year veteran of innovation and technology within the financial services sector and has worked for DBS Bank and the World Bank among many others. He has advises many corporates on how to maximise the opportunities from digital disruption.

As the Principal Lecturer of Information Systems and Director of the Master of IT in Business (Financial Technology & Analytics) Programme in SMU's School of Computing and Information Systems, he teaches topics such as Digital Banking and FinTech, Global Sourcing of Technology and Processes, Digital Transformation in Retail Banking Technology, and more.

Wondering how you may be disrupted in the era of Digital Transformation?

SMU Executive Development's Digital Transformation with AI for Leaders Programme will explore the AI and digital technologies transforming businesses today and learn how to leverage them to innovate business models, enhance practices, and improve profitability. More information about the programme here.

Find out what SMU Executive Development can do for you:

Custom Programmes• Short Courses • Immersion Programmes